In a world bursting with investment options and constant market noise, simplicity still reigns supreme. For individual investors with a long-term horizon of fifteen years or more, the evidence is clear: few strategies match the efficiency and consistency of a disciplined buy-and-hold approach using index funds.

Whether you choose a straightforward Total Market or S&P 500 fund, or opt for a well-balanced, Boglehead-style portfolio of three or four broad, low-cost index funds or ETFs—covering U.S. stocks, international equities, and bonds, you’re anchoring your financial future in proven principles. Even adding a modest slice of alternatives like REITs, gold, bitcoin, or small-cap value stocks can add diversification without straying from the core philosophy.

In most cases, retail investors can achieve their financial goals through disciplined saving, regularly setting aside part of their monthly income, resisting the urge to make frequent changes, and remaining committed during inevitable market downturns. Time in the market consistently beats trying to time the market.

However, the “Just VOO and Chill” crowd may be in for a rude awakening. Index funds are widely regarded as safer than picking individual stocks—and comparatively speaking, they are. But not all indexes are created equal, and market conditions at the time of purchase matter greatly. Although index funds have a “self-cleansing” nature that gradually dilutes concentration risk, their bundled structure creates price rigidity. At any given time, the S&P 500, for example, includes a mix of winners and losers. Its success largely depends on having more winning stocks than losing ones, and on the magnitude of those gains outweighing the losses. At present, approximately 3 out of 5 constituent stocks have had a positive return this year.

Welcome to InvestMart

We can imagine a first time shopper walking into a big department store of investment products being overwhelmed by the selections available. The store is crammed with busy shoppers buying items and lined up at the return desk.

A shopper may not have any prior knowledge of pricing, so they naturally will look around for clues: in-store advertising, markers such as “on sale” or “price drop,” or more likely, they watch what other people are buying, assuming there should be wisdom in the crowd. Younger people may be loading up on the hottest trending goods, while some older folks are picking through the discount bin.

If the day you walked into InvestMart was March 10th, 2000, you would have seen a frenzy of people buying everything they could get their hands on in the technology department. You wouldn’t know it, but the price of nearly everything in the store was high that day, and everything in the technology department was astronomically overpriced, or tied to a doomed sector.

Unless you were picking through the bargain bins or meandering through the quiet bond aisle with the retirees, it would have been one of the worst possible days to shop at InvestMart.

The outcomes of shopping on this day may have been devastating based on what you purchased and your investment goals.

For example, if you had gone along with the crowd, who were piling their carts with the “Janus Global Technology Fund” or the “Merrill Lynch Internet Strategies Fund” or the aptly named “Chicken Little Growth Fund,” you would have been wiped out within a year. Those funds collapsed and had to be closed or consolidated into other funds at pennies on the dollar.

But it wasn’t just the YOLO, “this time it’s different” crowd piling onto tech funds — the VTSAX and Chill crowd was affected as well. If you were “all in” that day, how much time would have been lost awaiting to see returns?

If you had invested in a broad index of large cap growth stocks, such as the Nasdaq 100 or even a standard cap-weighted growth fund like Vanguard’s VIGAX, you would have waited nearly fourteen years to see your initial investment recover and start appreciating.

If you had invested in the S&P 500? 6 years 3 months, and immediately followed by an additional 4 years 10 months due to the GFC .

If you had invested in a broad index of the U.S. stock market? 5 years 8 months, and immediately followed by an additional 4 years 5 months due to the GFC .

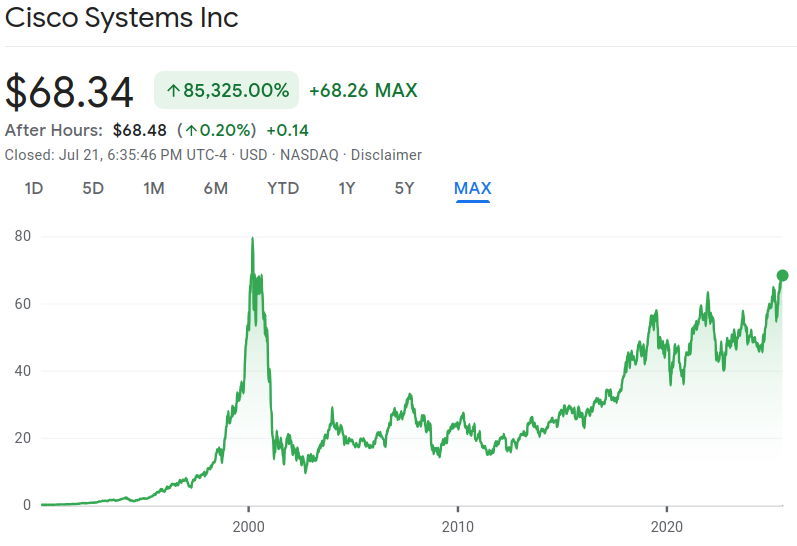

Cisco System is an example of a great company with strong fundamentals that was so overvalued by rampant market speculation that it still has not recovered from its all time high price in 2000.

Few investors had the patience to wait it out, and sold at a substantial loss in order to pivot to a better performing asset class, which at the time were emerging markets, value and small cap stocks. Those options would have done well at first, but ironically, after the cleansing out of speculative junk, the technology sector was trading at a massive discount and was poised for a twenty five year bull market that made fortunes for those who were waiting on the sidelines and wise enough to go all in on the dip.

Every investor’s a genius when backtesting. But in 1997-2000, there were plenty of seasoned investors, including Warren Buffet Harry Dent, Robert Shiller, Albert Edwards, and Howard Marks who publicly decried the emperor’s new clothes. The Nasdaq Composite, heavily weighted with technology stocks, traded at a P/E ratio of around 200 — which was irrational to the point of absurdity. As of July 21, 2025 it is 29.99.

Where’s The Exit?

The modern world of investing makes it very easy to get in, but most investors don’t have a plan to get out.

Perhaps it’s not a coincidence that most ETF investment products on the market show one year, three year, five year, ten year and “since inception” returns. Today there are more ETFs than there are stocks, and many are so new that there’s no way to gauge any meaningful track record. At this point in market history, the compound annual growth rates of the older funds all tend to look pretty good, and anything that’s been around since before the GFC is going have much of that period of devastation averaged out. Fifteen years seems like a long time to gauge the reliability of an investment. Is it?

In a standard taxable brokerage account, there are powerful incentives to buy and hold — at least once an investor realizes that buying high and selling low is bad. There’s laziness, commitment bias, sunk-cost fallacy, uncertainty and not to mention that taking profits on big gains can have significant capital tax implications.

The common wisdom among the popular retail investment community is to decide on an asset allocation strategy and buy and hold that portfolio of stocks, bonds, index funds, gold, assets and etfs as long as possible. We can opt to rarely peek, or watch the value go up and down and up and down, rebalance back to our target proportions once a year and hope that it appreciates at the point where we need to start taking money out. But what happens if there’s an unexpected need to exit all at once? What if at that moment the market is down 40, 50 or even 70 percent?

During deep recessions, when all assets decline in value, people often simultaneously lose their source of income and may be forced to sell their investments at a considerable loss to pay the bills. If your portfolio is in risky assets, just keep in mind such situations have happened twice in the past twenty five years and will indubitably happen again.

Fixed income investors usually understand this concept well, as they are in a position where they may not have the option to go back to work while they ride out the crash — their investments are their lifeline. They are much less concerned with accumulating wealth than preserving what they have. Millennial and younger investors who’s experience has been limited to an unprecedented fifteen year bull market, where the number always trends up or bounces back relatively quickly, may underestimate just how completely upside down things can get, and how long a bear market can drag on.

If you’re in your 40s, 50s or 60s and planning for retirement, just remember that FOMO is powerful and the Shiller CAPE ratio, one of the most reliable barometers for an overvalued market, is back up to a point that historically doesn’t favor aggressive strategies, no matter what the talking heads say or how great the fundamentals may seem. But to quote Keynes, “The market can remain irrational longer than you can stay solvent.”

Enter Sector Investing

For more hands-on retail investors, an advanced tactical strategy known as sector investing may be worth exploring. This approach can range from a straightforward buy-and-hold method to a more active style, where investors regularly rebalance their portfolios through targeted monthly contributions or tax-loss harvesting in response to shifting market conditions.

It’s important to note that sector investing is an active management strategy. Over the long term, it is unlikely to outperform the broader market on a risk-adjusted basis. However, it can offer greater downside protection and upside potential during periods of volatility by strategically adjusting exposure across market sectors based on their relative valuations and unique characteristics.

Sector investing may appeal to individuals with specific financial goals within a shorter time horizon, such as those targeting retirement. This is where capital preservation and minimizing losses can take precedence over maximizing returns. In such cases, the priority shifts from seeking excess performance to managing risk and ensuring the portfolio stays above a minimum viable threshold needed to meet essential financial objectives without resorting to a significant allocation to bonds which lead to long term drag. By selectively allocating across different equity market sectors based on their defensive qualities, valuations, or economic outlook, investors can aim for more favorable risk-adjusted returns. This proactive approach may help cushion against market downturns while still allowing for strategic growth opportunities.

The Market Sectors

According to Wikipedia, The Global Industry Classification Standard, or “GICS” is a system of industry categorization developed in 1999 by MSCI and Standard & Poor’s for use by the global financial community. The GICS structure consists of 11 sectors, 25 industry groups, 74 industries and 163 sub-industries into which S&P has categorized all major public companies.

The sector investor will only be concerned with monitoring a portfolio across these 11 sectors:

- Energy

- Materials

- Industrials

- Utilities

- Healthcare

- Financials

- Consumer Discretionary

- Consumer Staples

- Information Technology

- Communication Services

- Real Estate

Both Vanguard and SPDR, two of the industry’s most prominent ETF providers, offer low-cost sector-specific funds that track cap-weighted indexes for each of the 11 GICS sectors. These products allow investors to gain exposure to distinct areas of the economy—such as healthcare, technology, or energy—while maintaining flexibility in portfolio construction.

SPDR and Vanguard sector ETFs differ in their underlying indexes, portfolio composition, and investor appeal. SPDR sector ETFs, managed by State Street Global Advisors, track the Select Sector Indices derived from the S&P 500, resulting in a more concentrated portfolio of large-cap U.S. stocks. Vanguard’s sector ETFs, on the other hand, follow MSCI indexes, which include a broader mix of large, mid, and small-cap stocks, leading to significantly more holdings per fund. For example, Vanguard’s sector ETFs collectively hold over 2,500 stocks, while SPDR’s hold just over 500. This means Vanguard offers greater diversification, while SPDR provides more focused exposure to the largest companies in each sector. Vanguard’s offerings, with their broader reach and slightly lower expense ratios, are often preferred by long-term, buy-and-hold investors seeking comprehensive sector exposure.

One key reason for their rising popularity is the simplicity and intuitive appeal these ETFs offer. For retail investors navigating macroeconomic shifts, targeted sector funds provide a means to express investment themes—whether it’s betting on a cyclical recovery or hedging against inflation through defensive sectors like utilities and consumer staples.

Beyond tilting a existing portfolio toward a few sectors, a tactical sector investor may use a buy-and-hold approach involving a selection or the full suite of sector ETFs which manages risk by isolating and containing losses within specific parts of the portfolio.

Think of a sector ETF portfolio like a well-designed oil tanker navigating volatile seas. Just as an oil tanker is built with separate compartments to keep liquid cargo from shifting and destabilizing the vessel, a portfolio made up of sector ETFs can isolate risk and limit damage from downturns in any one part of the economy. Defensive sectors—such as healthcare, consumer staples, and utilities—act like the ship’s ballast compartments, adding balance and resilience. Even if one sector experiences turbulence, the others remain steady, preventing a total portfolio capsizing.

By underweighting or excluding more volatile sectors—like financials or consumer discretionary—an investor can further stabilize their investment “hull,” reducing exposure to sudden shocks while maintaining exposure to those showing strong fundamentals or resilience. The compartmentalization doesn’t eliminate risk, but it prevents it from spilling over and sinking the whole strategy.

This tactical versatility enables a more customized investment experience—one that can lean aggressive during expansionary periods or defensive when markets show signs of stress.

Sector Types

The 11 market sectors are often grouped into three broad categories—Defensive, Sensitive, and Cyclical—based on how they typically respond to economic conditions:

Defensive Sectors

These sectors tend to perform steadily regardless of economic cycles because they provide essential goods and services.

- Consumer Staples: Includes food, beverages, household products, and supermarkets.

- Healthcare: Covers pharmaceuticals, medical devices, hospitals, and biotech.

- Utilities: Provides electricity, water, and gas—services people need in any economy.

These sectors are considered “safe havens” during downturns due to consistent demand.

Sensitive Sectors

These sectors are moderately affected by economic fluctuations and often depend on business investment and consumer sentiment.

- Communication Services: Encompasses telecom, media, and internet companies.

- Energy: Includes oil, gas, and renewable energy providers.

- Industrials: Covers transportation, aerospace, construction, and manufacturing.

- Information Technology: Includes software, hardware, and semiconductor companies.

Performance in these sectors can swing with market sentiment, but they’re not as volatile as cyclical sectors.

Cyclical Sectors

These sectors are highly responsive to economic cycles, thriving during expansions and struggling during recessions.

- Consumer Discretionary: Retail, entertainment, automobiles—non-essential goods and services.

- Financials: Banks, insurance, and investment firms that depend on economic activity.

- Materials: Producers of raw materials like metals, chemicals, and forestry products.

- Real Estate: Includes REITs and property management—sensitive to interest rates and economic growth.

Investors often rotate into these sectors during economic upswings to capture growth.

Active Management Approaches

Portfolio Tilt

Investors sometimes tilt a portfolio by adding exposure to select sectors. For example, a total market investor in VTI or VTSAX may wish to add a defensive tilt by adding Utilities or Consumer staples. This is a popular approach for investors who wish to avoid bonds in taxable brokerage accounts. Keep in mind that both of these defensive sector funds have higher than average dividends which have tax implications in a standard brokerage account.

Passive Equal Weight

A viable strategy that follows our analogy of the oil tanker is to allocate a portfolio to all eleven sectors equally and maintain that weight via rebalancing. This passive approach is relatively easy to manage if you are contributing regularly, as you can simply “top up” the sectors that are underweight due to growth in other sectors.

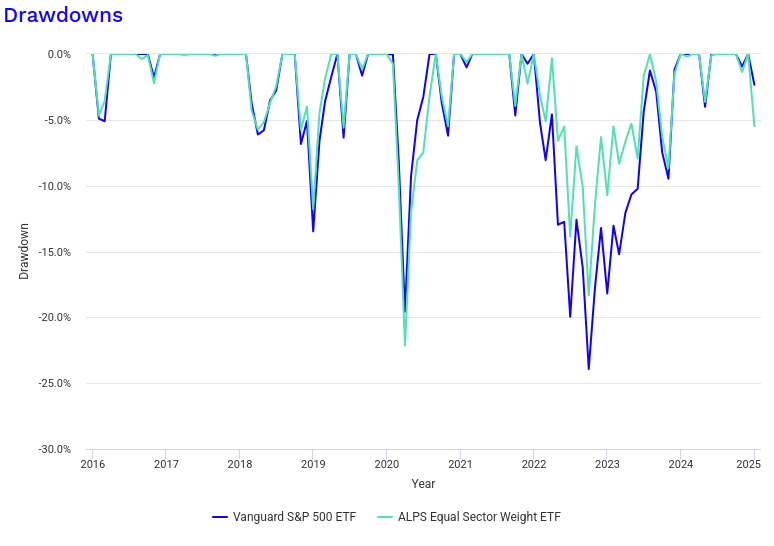

Don’t want to manage this yourself? ALPS has an ETF that does this automatically by investing equal proportions in 11 Select Sector SPDRs and rebalances quarterly. The ETF currently has a reasonable 0.25% expense ratio, which is $2.50 per year for every 1k in the fund.

Thanks to ALPS 2009 inception date, we can review the relative price performance of the fund and note that it underperforms the broader index it tracks, the S&P 500. However, it does show evidence of lower volatility with a -10.72% drawdown during its worst year compared to -18.19% in SPY. The market of 22-23 was a recent example of overvaluation correction and inflation.

Passive Weighting & Exclusion

Similar to equal weighting is to simply select a subset of the sectors that tilt toward a risk appetite or investment thesis. One of the advantages of sectors is they often have low return correlations. For example, the recently outperforming Technology sector has a low correlation to Utilities.

An example simple fund passive strategy built around a thesis that AI and automation will be the dominant theme over the next decade might be the following target allocation:

- 30% Technology – For AI leading firms and software

- 20% Industrial – For AI’s impact on industrial automation and workforce

- 50% Utilities – Data centers need energy and utilities provide defensive ballast.

The above portfolio backtests favorably to the S&P 500 over the past decade with lower risk. It’s also possible to expand it to other sectors as markets change.

Active Weighting & Management

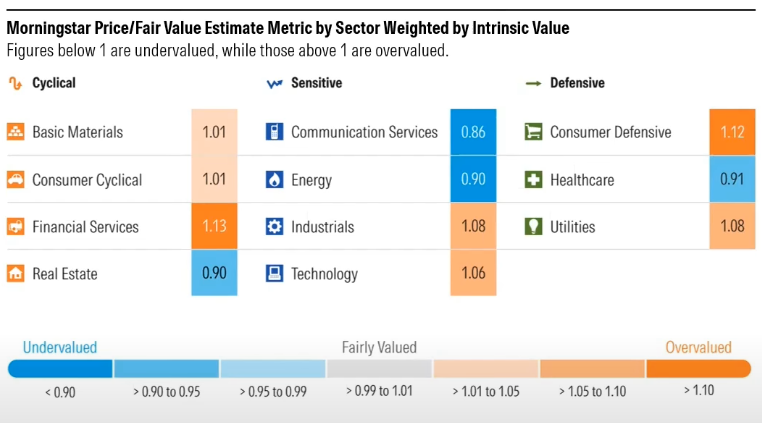

A fully active strategy is not for everyone. It will involve regularly analyzing the market, selecting sectors and adjusting weights based on an evolving thesis, or simply using a data-driven approach where flows or rebalancing is guided by relative valuations. Professional fund managers struggle to do this effectively, so there’s a good chance you’ll underperform unless you stick to a broad thesis over time and accept the relative risk associated.

Tools For Active Management:

- Morningstar – Morningstar is one of the most trusted sources for personal investor analysis. Each quarter they report a Quarterly Outlook Report as a video and PDF (for members). Their report includes a free professional sector analysis. One of the easiest options is to subscribe to their free YouTube channel and watch their report each quarter. Their subscription is reasonable for the value their research tools deliver to the DIY retail investor.

- GuruFocus Sector Report – Every six months Guru Focus provides the Shiller Cape data by sector for free. While six months is a long time to wait, it’s not a bad idea to make major rebalancing decisions across longer timelines that allow your decisions to take hold.

- Charles Schwab – Schwab also provides ongoing sector analysis on their sectors blog.

- Investment Firm Reports – Most Major Investment Firms (Vanguard, Schwab, Blackrock, Goldman Sachs) provide annual or quarterly reports that include actionable data on sectors.

Conclusion

A conservative buy-and-hold sector ETF portfolio designed to reduce risk typically emphasizes stability and income while minimizing exposure to volatile or cyclical sectors. This strategy might overweight defensive sectors such as utilities, healthcare, and consumer staples, which tend to perform reliably across economic cycles due to consistent demand. At the same time, it may underweight or exclude more volatile sectors like consumer discretionary, materials, and financials, which are more sensitive to economic fluctuations and interest rate changes. By selectively allocating capital to sectors with historically lower volatility and stronger dividend profiles, investors can build a portfolio that prioritizes capital preservation and steady returns.

A more active tactical approach emphasizes periodic rebalancing, often through monthly contributions or tax-loss harvesting, to fine-tune sector weightings based on valuation metrics and risk profiles. The goal isn’t to chase market-beating returns, but to preserve capital and generate steady, risk-adjusted performance by leaning into defensive sectors when volatility spikes and cautiously rotating into more sensitive or cyclical areas during periods of recovery.

Either of these approaches are particularly well-suited for those nearing retirement or seeking to minimize drawdowns during market downturns, while still maintaining diversified exposure to the broader economy through low-cost, cap-weighted ETFs.